Incorporating in Singapore?

Start with the Right Partner

Incorporating a company in a foreign country can feel complex — but not with us. Our platform assigns you an experienced and ACRA-licensed CSP team and streamlines every step of the Singapore company registration process.

You deserve more than a chatbot and broken promises.

Serious Support for Serious Entrepreneurs

When you're building something real, you need more than chat windows and shortcuts. You need an experienced service provider team that can advise and support you across every aspect of your business — from incorporation and accounting to taxation, work visas, and ongoing compliance. No gimmicks — just serious support for entrepreneurs who are serious about doing it right.

In a noisy market, trusted guidance makes all the difference. Low prices rarely come with high standards.

We’re Built for Reliability — Not for Investor Pitch Decks

Services

All Services You May NeedPlatform

Leading Online PlatformQuality

Satisfied CustomersPeople

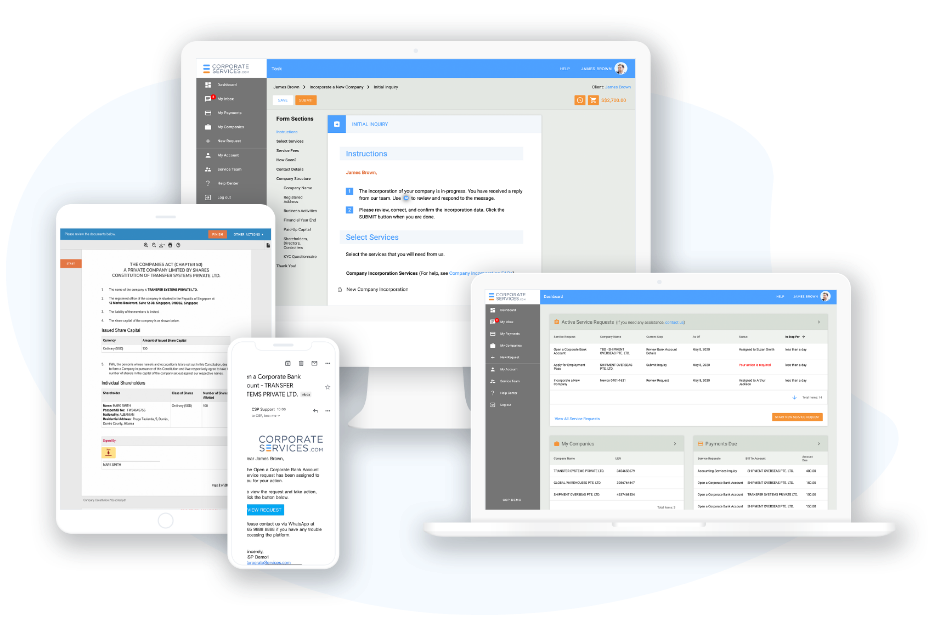

Experienced CSP TeamsOur corporate services platform makes the company incorporation and its ongoing administration simple.

- All incorporation and compliance tasks managed by a dedicated team — just a click away whenever you need support

- Robust document management with secure e-signature support

- Purpose-built workflows that guide you step by step through each task

- Real-time tracking of ongoing tasks and submissions

- Automatic alerts for compliance deadlines and upcoming requirements

Reviews from our clients

Varun Chadha

Tirun Travel

Thank you for the efficient incorporation of our new company. In my experience with your team, all communications have been clear, thorough, and accurate...

Read moreBerner Teorica

BRT Solutions

Working with your firm has been a pleasure. The guidance and insight you provided from start to finish made the entire incorporation process smooth and effortless. Thank you...

Read moreKaren Lam

Thoughtful Foods

We have been your clients for almost a year, and I highly commend you for the professionalism and the courteous attention that is always shown by Jacqueline ...

Read moreCompany Law and Business Regulations in Singapore

Read our comprehensive guides about setting up and managing your Singapore company.World-class partners